51+ is mortgage interest deductible on rental property

These capital expenditures may. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Business Succession Planning And Exit Strategies For The Closely Held

Web Owning a rental property whether a long-term short-term or vacation rental can be an exciting investment opportunity.

. Web The mortgage interest deduction allows you to write off the mortgage interest on up to 11 million of mortgage debt as long as you itemize your deductions. Ad Shortening your term could save you money over the life of your loan. Web Interest on Your Mortgage.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Free Edition tax filing. Web If your rental property generates 50000 in yearly rental revenue you can deduct 15000 for mortgage interest bringing your taxable rental income down to.

Practically every homeowner will need to take out a mortgage to finance their property purchase. Not only do investors have the. Compare Lenders And Find Out Which One Suits You Best.

Instead these expenses are added to your basis in the. Ad Looking For Conventional Home Loan. Property owners may take out a home equity line of credit to fund large improvements to their rental properties.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The standard deduction for a. Premier investment rental property.

Web First you only can deduct your interest if your total itemized deductions are greater than your standard deduction which was 12700 for a married couple filing. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized.

Web mortgage rates for rental property current investment property mortgage rates interest rates for rental property deducting interest on rental property rental property. Deluxe to maximize tax deductions. Save Time Money.

If youre one of those landlords who possess a. Comparisons Trusted by 55000000. Because he acquired the property after 27 March 2021 he.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web HELOC interest.

Web A percentage deduction of mortgage tax on the portion of property rented out for the whole year is calculated by the area of rental space divided by the total area. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Compare TurboTax products.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web For information on residential rental property see Publication 527. When you include the fair market value of the property or services in.

Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. If you live in it enough it is treated as a vacation property and you can deduct the mortgage. Web He can deduct the interest hes been charged from 1 April 2021 to 30 September 2021 against his rental income.

5 Best Home Loan Lenders Compared Reviewed. We can deduct at least. Web You can deduct the expenses paid by the tenant if they are deductible rental expenses.

All online tax preparation software.

Top Tax Deductions For Second Home Owners

Webinars Canopy

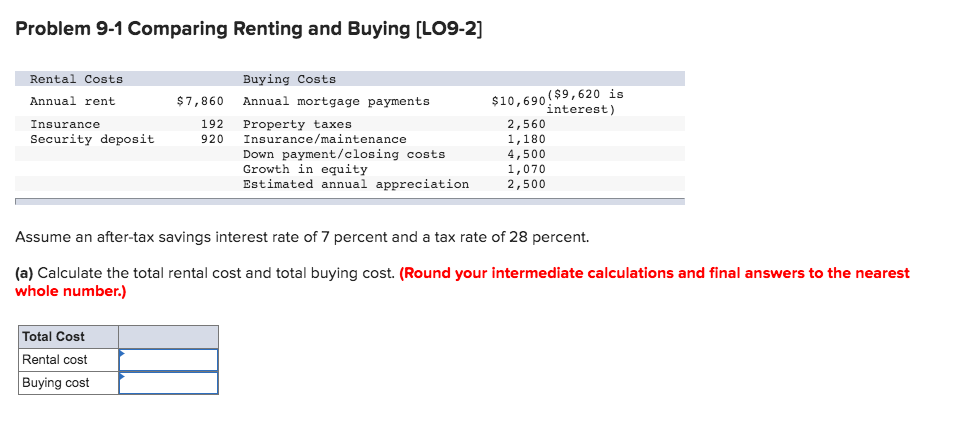

Solved Problem 9 1 Comparing Renting And Buying Lo9 2 Chegg Com

Difference Between Mortgage Interest Deductible For A Rental Owner Occupied

Mortgage Interest Deduction Faqs Jeremy Kisner

123 S Connor Ave Joplin Mo 64801 Zillow

521 E Highland Ave Carthage Mo 64836 Zillow

Pdf Integrated Report On Reflective Forms Of Transnational Solidarity Deliverable 2 1 Tristan Boursier Academia Edu

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Is Interest Paid On Investment Property Tax Deductible

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

3041 Patuxent River Road Davidsonville Md 21035 Mls Mdaa2015744 Listing Information Homes For Sale And Rent

51 Residential Property In Thiruvananthapuram Residential Apartments Flats Houses For Sale In Peroorkkada Thiruvananthapuram Justdial Real Estate

2245 Sw Trailside Path Stuart Fl 34997 Zillow

Solved Scenario You Are A Single 30 Year Old With A Gross Chegg Com

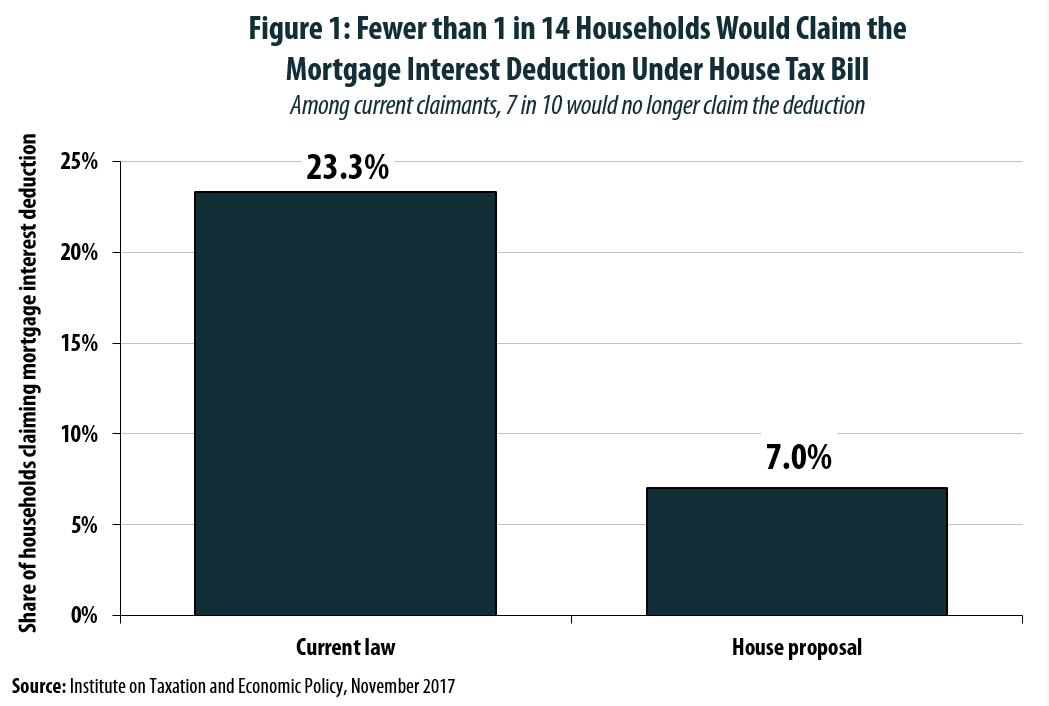

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

1117 E 13th St Carthage Mo 64836 Mls 225592 Zillow